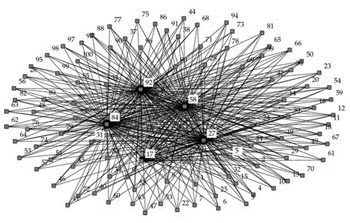

Major players on the FX market

The interbank market

Roughly 40% of all FX trade takes place on the interbank market. This is the top level of the FX market and it is only open to really large traders. A banks access to the market depends on the size of their “line”, i.e. how much money they are trading with.

These are the three major components of the interbank market:

These are the three major components of the interbank market:

- The spot market

- The forward market

- Society for World-Wide Interbank Financial Telecommunications (SWIFT)

Individual purchases comprised of several billion units of currency is not an unusual occurrence on the interbank market. Another characteristic of the interbank market is the dominance of extremely small spreads.

On the interbank market, banks can either trade directly with each other or go through electronic trading platforms. It is normally only the largest banks that trade directly with each other, without any third-party platform in between. At the time of writing, over one thousand banks are using either the Thomson Reuters Eikon trading platform or the Electronic Broking Services (EBS) trading platform.

A majority of the really large currency traders at the interbank market level are based in Europe or in the United States. Some of the largest ones in the United States are Citi, JP Morgan Chase, Goldman Sachs and Bank of America Merrill Lynch. In Europe, three of the major currency traders are found in the United Kingdom: Royal Bank of Scotland, Barclays Investment Bank and HSBC. Other examples of large currency traders based in Europe are Deutsche Bank in Germany, BNP Paribas in France and UBS AG in Switzerland.

National central banks

National central banks can be seen as major players on the currency market even though they normally tend to focus on adjusting national interest rates rather than actively purchasing or selling currency. Their actions can have a major impact on the FX market.

Bureaux de change

Bureaux de change

Bureaux de change, or exchange offices, is where ordinary consumers and small to mid-sized businesses can go to exchange one currency for another. Such offices are typically found in airports, major railway stations, international ferry terminals, and similar. It is also quite common for large cities to have one or several exchange offices in the city center.

Money transfer office / Remittance office

Money transfer offices help consumers and small to mid-sized businesses transfer funds from one country to another. You might for instance want to wire money to a business partner or pay for a purchase by wiring money to the seller through a money transfer office. A very common type of transfer is the remittance, where a person living and working in Country A wants to send money home to family or close friends in Country B.

Even though each individual transfer from a money transfer office tend to be small, the total amount of money sent through money transfer offices each year is significant. Even if we only look at remittances and ignore all the other transfers, were are talking about the equivalent of several hundred billion USD per annum.

In the year 2014, the total remittances equaled an estimated 580 billions USD. Of these, over 435 billion USD went to third-world countries. Remittances can be a very important source of income for families in third-world countries who have a family member working abroad.

Two examples of well-known chains in the money transfer office industry are Western Union and UAE Exchange.

Funds

Traditional funds, retirement funds, hedge funds and other funds can all be seen as players on the FX market. When a fund wants to purchase a particular asset, it may have to convert currency first in order to pay for it. Fund managers can also elect to directly engage in speculative FX trading in order to make revenue for the fund, or purchase currency as a longer-term investment strategy.

When it comes to FX trading and exchange rates, hedge funds draw a lot of medial and political attention to themselves in the 1990s when it became clear that motions set into play by a large hedge funds can have a huge impact not only on FX trading but on the efficiency of national central bank programs.

Companies paying bills in foreign currency

It is not unusual for companies to have expenses that must be paid in foreign currencies. Even though each transaction might be small from a global perspective, the combined transactions of a multitude of companies – especially the large multinational ones – can impact the FX market. These transactions can also serve as an indicator for FX traders about the state of international trade. Which currencies are companies flocking to buy? Are there any discernible trends to be spotted? What are the current patterns telling us about what to expect in the near future?

Retail FX trading platforms online

Retail FX trading platforms online is a fairly new invention in the history of FX trading, and even though each individual account tend to include just a tiny amount of money (from an FX market perspective), the collective impact of retail FX trading can be noticeable. It is also important to take into account that some retail FX trading platforms act as market makers, trading directly with their clients instead of acting as third-party brokers. This gives the platforms increased power to set their own exchange rates and have clients abide by them, which in turn open up for cross-platform arbitrage trade.

This article was last updated on: June 17, 2016